On January 12, 2026, Anthropic released Claude Cowork as a “research preview”—positioned explicitly as “Claude Code for the rest of your work”—inside the Claude Desktop macOS app. Cowork’s distinctive claim is not “better answers,” but permissioned execution: you point it at a folder, and it can read, create, edit, move, rename, and (critically) delete files while also taking over a browser workflow when allowed.

What made Cowork land as an investor-grade catalyst was the combination of (a) outcome execution in a mainstream desktop form factor and (b) the speed at which it was shipped. Anthropic staff described Cowork as built in roughly “a week and a half” / under two weeks, with reporting that Claude itself coded “pretty much all” of it and that developers were running ~3 to 8 Claude instances in parallel to implement and debug features. In other words, the product was a live demo not only of automation, but of software production velocity.

One mid-tier product marketer reacted,

Cowork was initially gated behind Anthropic’s power-user Max subscription, which is explicitly tiered at $100/month (“Max 5x”) and $200/month (“Max 20x”), advertising 5x and 20x more usage per session than the Pro plan. Within days, it broadened: by January 16, 2026, Engadget reported Cowork was opened to $20/month Pro subscribers as well (with Anthropic cautioning Pro users may hit limits sooner).

The equity market response was immediate and measurable. In the days following Anthropic’s announcements, RBC highlighted a broad software selloff, with shares of Salesforce, Workday, Intuit, and Snowflake falling roughly 6% to 13% as investors re-ran the playbook on where pricing power sits when an agent can do multi-step work across tools. That repricing was not confined to single names: Bloomberg reported that a Morgan Stanley basket of software/SaaS names was down ~15% year-to-date, after declining ~11% in 2025—i.e., a two-year narrative overhang now had a new “proof point” to trade on.

You can see the same risk premium in sector-level numbers. The iShares Expanded Tech-Software Sector ETF (IGV) showed a NAV of ~$98.35 and ~‑6.96% NAV return year-to-date as of January 16, 2026, with ~$6.678B in net assets, ~67.9M shares outstanding, and an indicated portfolio P/E ~42.03 (a reminder that even after drawdowns, software remains a long-duration asset class that is hypersensitive to perceived unit-economics regime shifts).

Two additional quantitative context points matter because they explain why this time the market cared about “agents” rather than treating them as another feature cycle. First, AI is now a line-item budget reality: Investopedia cited a Jefferies survey indicating ~12% of IT budgets dedicated to AI “this year,” up from ~6.5% the prior year, alongside an expectation of ~10% cloud spending growth—meaning buyers are actively reallocating dollars, not just experimenting. Second, capability is still uneven: TIME reported that Opus 4.5 (the model powering Cowork) completed 9 of 240 tasks in the Center for AI Safety’s Remote Labor Index—useful for investors because it frames the near-term impact as pricing/seat pressure and workflow redesign, not instantaneous full autonomy.

So the core underwriting problem is not whether Cowork “works.” The underwriting problem is whether outcome-executing agents change (1) where pricing power migrates, (2) which layer becomes the enterprise control plane, and (3) what observable metrics prove real spend compression rather than narrative-driven volatility.

Clients have been asking whether Claude’s rapid enterprise penetration—sparked by the Cowork release—is a durable inflection or just another short-lived AI hype cycle.

In today’s article, we’ll address client asked questions that determine whether this becomes a lasting structural shift in software economics:

What is Agentic AI? Why did late 2025—rather than earlier GenAI cycles—become the point when “agents” started to matter for software valuations, and what system-level change triggered that shift?

Review of McKinsey, BCG & MIT, ISG late 2025 reports

When Anthropic released Claude Cowork—an agent that can read/write files, drive browsers, and complete multi-step tasks—the market immediately sold off a wide range of enterprise software stocks; which parts of the software stack actually face durable pricing compression, and which are structurally insulated?

Impact on Salesforce, Adobe, Atlassian, Workday, ServiceNow, Snowflake, Datadog, Twilio, and Intuit

What concrete evidence would confirm that agentic AI is reducing some SaaS spend rather than merely increasing usage after the initial Cowork-driven shock?

Please note: The insights presented in this article are derived from confidential consultations our team has conducted with clients across private equity, hedge funds, startups, and investment banks, facilitated through specialized expert networks. Due to our agreements with these networks, we cannot reveal specific names from these discussions. Therefore, we offer a summarized version of these insights, ensuring valuable content while upholding our confidentiality commitments.

Q1. What is Agentic AI? Why did late 2025 become the pivot point?

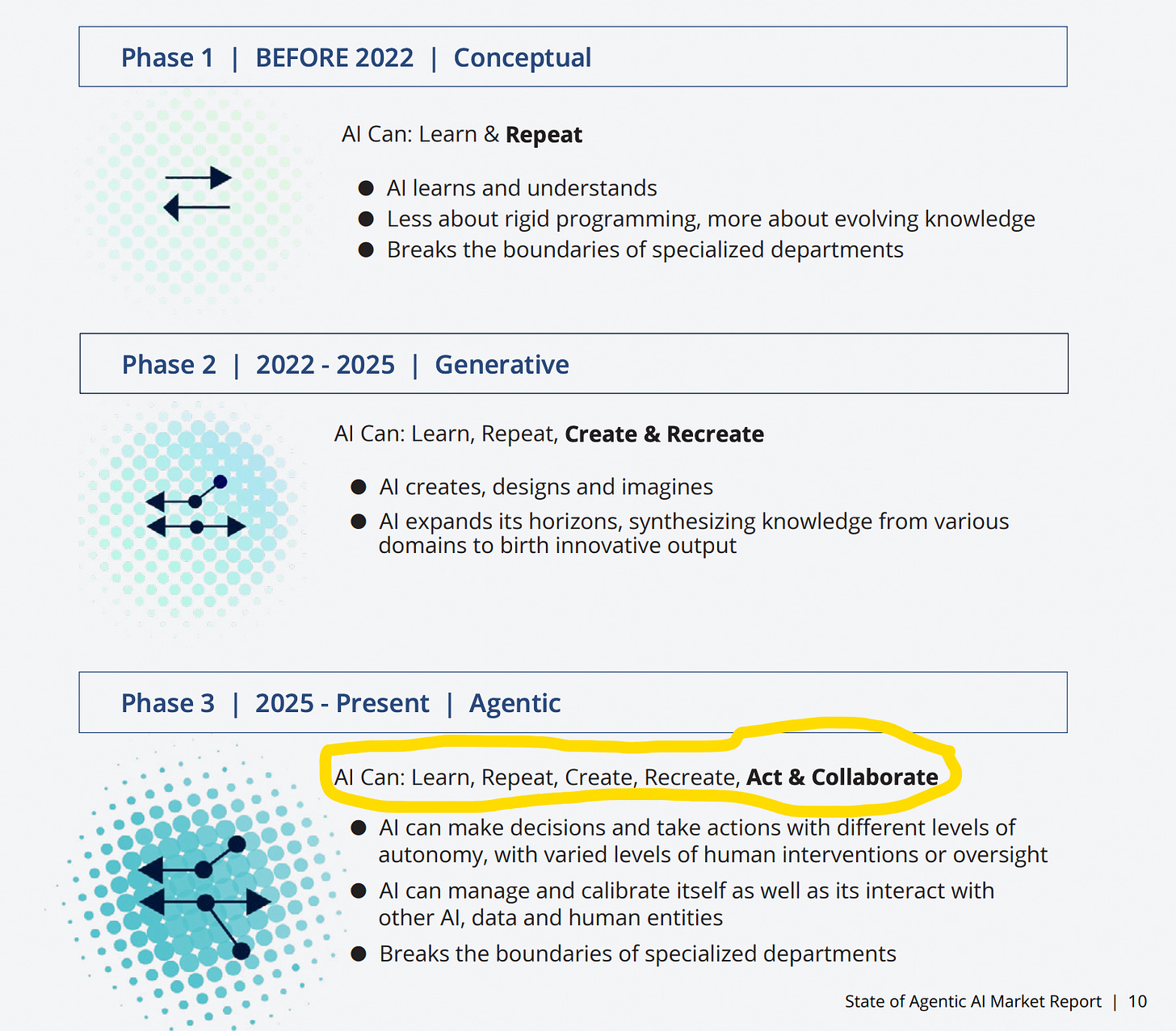

Agentic AI is best understood as the shift from “AI that answers” to “AI that executes.” Instead of producing text outputs that humans must manually turn into work, agentic systems can hold state, plan multi-step workflows, take actions across tools, and verify results—often producing real artifacts (spreadsheets, decks, tickets, code changes) as the deliverable.

What changed in late 2025 is that this was no longer a lab prototype or a brittle demo: vendors began shipping agent loops (plan → act → verify → iterate) inside permissioned environments with sandboxes, connectors, and governance primitives.

Source: ISG Market Report

Let’s review leading industry reports first before we talk about why late 2025 became a pivot point.

According to MIT and BCG’s Nov 2025 report, organizations with the highest level of agentic AI adoption are far more likely to see increased applications of the technology across various modes of decision-making. The report said, 76% of respondents to survey say they view agentic AI as more like a coworker than a tool.

But the largest impact of agentic adoption is augmenting human judgment: 79% of extensive agentic AI adopters say they are investing in using AI to generate insights for a human decision maker.

Source: MIT and BCG Agentic AI Nov 2025 Report (MIT Sloan and BCG conducted survey of 2,102 respondents representing 21 industries and 116 countries and 11 executives leading AI initiatives in a broad range of companies and industries, including financial services, technology, retail, energy, and health care.)

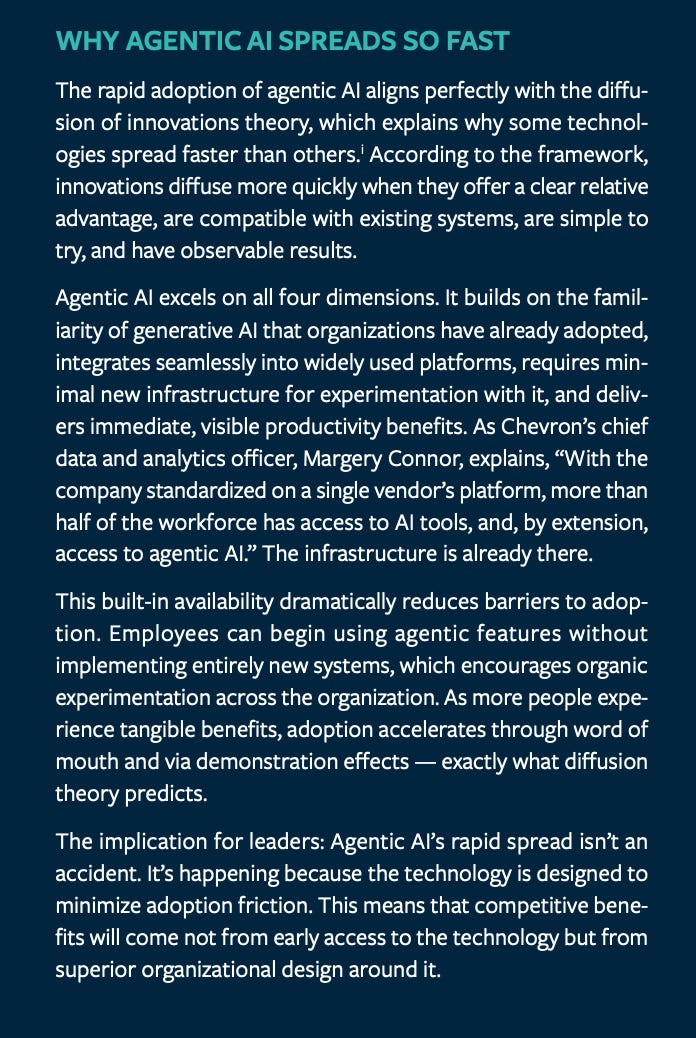

The report explains, why Agentic AI spreads so fast:

Takeaway is because the infrastructure and user familiarity from GenAI are already in place, agentic features can spread organically without major new deployments. That means competitive edge will come less from “having access first” and more from how well leaders redesign workflows, controls, and incentives around agents.

According to recent McKinsey’s analysis,