Plan for a Power-Led Capex SuperCycle: Why 27% of Data Centers Shift to Primary On-Site Power Generation by 2030

Power is the rate-limiter. Lawrence Berkeley National Laboratory estimates U.S. data-center electricity rising from 176 TWh in 2023 to ~325–580 TWh by 2028, which is ~6.7–12.0% of total U.S. electricity depending on economy-wide growth.

AI isn’t waiting on the grid. Over the next few years, data-center power demand is set to jump, power utility queues are measured in years, and “optional” levers like liquid cooling, high-efficiency UPS, and on-site generation are becoming the gating factors for shipping compute, not just trimming OPEX. Power has moved from a utility bill to the rate-limiter—and the source of schedule alpha.

In the last few years, Solid-oxide fuel cells programs have scaled from pilots to portfolio strategy. Solid-oxide fuel cells (SOFCs) slot neatly into power plan: they’re modular (1–10 MW blocks), quiet, ultra-low NOx/PM, and can run 24/7 on natural gas, RNG, or hydrogen.

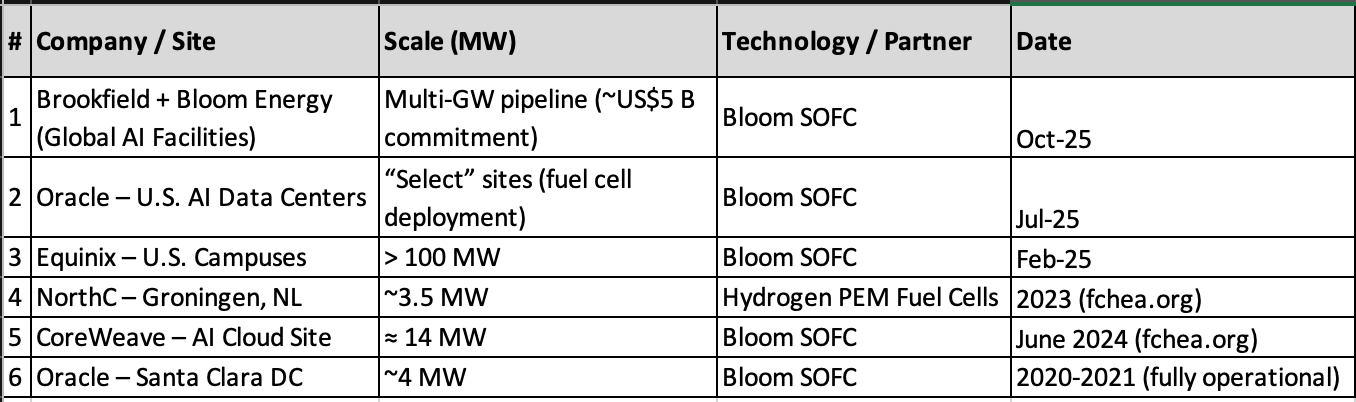

Recently, Equinix disclosed deployments surpassing 100 MW across 19 U.S. facilities; Brookfield announced a $5 B, multi-GW rollout targeting AI data centers; and Oracle expanded collaborations at select U.S. campuses. The pattern is consistent: hyperscalers and colo leaders are using SOFC blocks as schedule insurance—often paired with BESS for ride-through and black-start—so capacity arrives on time while utility work and transmission catch up.

In this piece, we’ll unpack:

10 Key Hyperscaler Power Efficiency Levers

What are the biggest levers to cut power across thermal management, UPS architectures, on-site generation, and control systems—and how quickly can each deploy at scale?

What should a vendor-selection scorecard actually look like?

Power Grid Queues and Timelines

How long does it take, and How do these capacity and bottlenecks differ by region—for example, between fast-moving markets such as ERCOT (Texas) or Southeast non-ISO utilities versus slower, study-heavy regions like CAISO (California), PJM (Mid-Atlantic), and MISO (Midwest)?

Trump’s policy changes

What is the recent Oct 2025 policy update? How could Trump’s policy changes regarding data center grid connections? What are the main changes in the stages of the U.S. grid connection process?

Would the policy push hyperscale operators toward building more behind-the-meter generation and storage capacity?

Fuel cells in AI campuses

Why on-site power and Where do fuel cells fit for AI data centers?

When do SOFCs beat turbines + BESS on TCO, permitting, and resilience?

Please note: The insights presented in this article are derived from confidential consultations our team has conducted with clients across private equity, hedge funds, startups, and investment banks, facilitated through specialized expert networks. Due to our agreements with these networks, we cannot reveal specific names from these discussions. Therefore, we offer a summarized version of these insights, ensuring valuable content while upholding our confidentiality commitments.

Q1. 10 Key Hyperscaler Power Efficiency Levers

The U.S. Energy Department’s 2024 data-center energy report says the sector’s electricity use is accelerating: about 7% CAGR from 2014–2018, jumping to 18% in 2018–2023, and projected at ~13–27% annually through 2023–2028.

Source: 2024 United States Data Center Energy Usage Report

Let’s quickly look at data center electricity projections by equipment types: